Unfiltered insights from OEMs, tier suppliers, and logistics leaders

Thank you to everyone who took part in our third annual survey on Automotive Packaging and Container Management.

This survey is proudly supported by Tri-Wall Circular – global leaders in sustainable packaging solutions.

At LConnect, I’ve been speaking directly with stakeholders across the automotive supply chain, from packaging engineers and logistics managers to sustainability leads and procurement heads, to uncover the most pressing challenges in packaging and container management today.

This isn’t analysis driven by assumptions. It’s a real-world snapshot of where the friction lies, captured in their own words. Below, I’ve outlined the seven most consistently raised issues (ranked by frequency and urgency) as shared by those on the front line.

What Keeps the Industry Awake at Night: A Summary of Top 2025 Challenges

Across dozens of responses, a few clear themes emerged. And notably, many of them haven’t changed since 2021, but the urgency around them has grown dramatically.

1. Container Loss, Damage & Lack of Visibility

Still the most cited issue. Containers go missing, get hoarded by suppliers, or return damaged with no accountability. Many still rely on spreadsheets to manage multimillion-euro assets.

“We track containers in Excel, so they go missing or sit broken for weeks with no one owning the problem.”

Takeaway: The call for real-time tracking, such as RFID, GPS, digital twins, is louder than ever. But this isn’t just about tech. It’s about changing the mindset: treating packaging like a production asset, not a throwaway crate.

2. Damage in Transit and Storage

From warehouse mishandling to moisture ingress (“container rain”), damage, especially to high-finish parts, is still too common.

“We treat packaging like junk, then blame the packaging when parts arrive damaged.”

Takeaway: Companies need better protective design aligned with real-world logistics, not just lab-tested theories.

3. Rising Costs and Cancelled Orders

Steel, resin, freight, input costs have soared. Some suppliers have cancelled packaging orders entirely. Others are scrambling to redesign with more cost-effective materials.

“The cost of packaging is now a barrier to even shipping parts.”

Takeaway: Firms are rethinking the entire cost model, exploring pooled systems, rentals, and material swaps to contain spend without compromising protection.

4. Lack of Strategic Thinking

Packaging is still too often treated as an afterthought, brought in only once damage has occurred or when transport is already planned.

“Other departments just see ‘a box. We’re trying to manage an entire ecosystem.”

Takeaway: Packaging needs a seat at the table from day one, alongside tooling, sourcing, and logistics. Every delay in integrating packaging increases the risk and cost downstream.

5. Resource Constraints & Legacy Thinking

Teams are stretched. New designs get deprioritised. Even when better solutions exist, legacy approaches win out due to lack of time and bandwidth.

“Packaging decisions get made by default, not by design.”

Tomorrow’s Risks Start Today

When asked about future challenges, respondents identified four major areas:

1. Regulatory Pressure (e.g., EU’s PPWR)

Compliance is no longer optional. The Packaging and Packaging Waste Regulation (PPWR) has made recyclability, reusability, and traceability a board-level concern.

“Sustainability used to be aspirational. Now it’s enforceable.”

2. Global Sourcing Driving One-Way Waste

With EV production ramping up in Asia and new sourcing footprints emerging, returnable packaging is being sidelined. The result? Rising costs, carbon output, and waste.

“We’ve globalised sourcing but not packaging. That means tonnes of scrapped containers.”

3. Automation Compatibility

Packaging needs to evolve for robotic handling, vision systems, and automation, but most current designs haven’t caught up.

4. Lack of Cross-OEM Collaboration

Despite the potential for shared systems, OEMs and suppliers still struggle to collaborate effectively on pooling or standardisation.

“Without collaboration, we’re stuck with waste and inefficiency.”

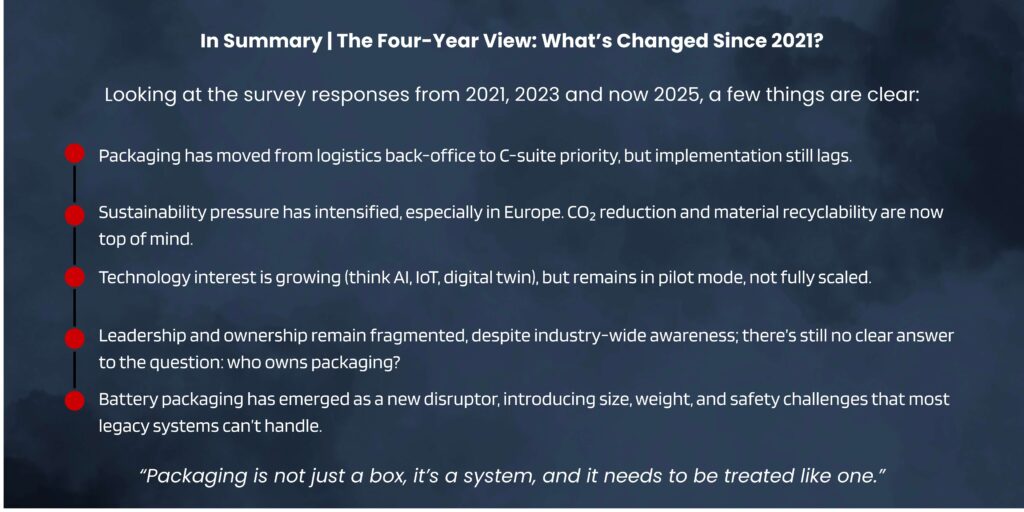

The Three-Year View: What’s Changed Since 2021?

One of the most telling parts of running the Automotive Packaging and Container Management Survey every two years is being able to track how sentiment, strategy, and operational realities shift (or don’t!) over time.

Looking across the 2021, 2023, and 2025 surveys, a pattern emerges: awareness is rising, but execution is still catching up. The industry now knows it has a packaging problem. But whether it’s equipped and resourced to solve it at scale is another question.

From Logistics Concern to Boardroom Topic

In 2021, packaging was still seen primarily as a logistics task: operational, transactional, and low-visibility. Senior executives weren’t particularly engaged unless there was a major cost spike or quality failure.

Fast-forward to 2025, and the tone has shifted. Packaging is now firmly on the radar of C-suite leaders, driven by rising costs, ESG commitments, and regulatory exposure. Yet respondents remain frustrated by a lack of clear leadership and ownership.

“Packaging is on the agenda, but no one owns it. Everyone has an opinion, but no one has a plan.”

This disconnect between visibility and responsibility is one of the defining features of the 2025 data. Senior interest is welcome, but without structural accountability, progress remains fragmented.

Sustainability: From Aspirational to Enforceable

Sustainability has evolved from a side conversation to a strategic imperative. In 2021, “eco-friendly packaging” was largely aspirational, something nice to aim for when time and budget allowed.

By 2023, we saw the first real movement. More companies experimenting with cardboard alternatives, higher truck fill rates, and reusable systems. But it was still mostly self-driven.

Now, in 2025, regulation is taking the lead. The EU’s Packaging and Packaging Waste Regulation (PPWR) is pushing packaging compliance to the top of the agenda, with companies facing increasing pressure to demonstrate recyclability, reduce volume, and account for lifecycle impact.

“Sustainability used to be about image. Now it’s about compliance. And cost. And risk.”

The urgency is palpable, particularly in Europe, but also growing in North America and Asia, where global suppliers are trying to meet divergent standards across multiple markets. The risk of inaction has become too great.

Technology: Still in Trial, Not Yet Transformative

Technology is another area where expectations are outpacing adoption.

In 2021, most respondents were unsure where to start. Tracking technologies (think RFID, barcoding, GPS) were seen as expensive or complex. By 2023, attitudes had warmed: companies were running pilot programmes, exploring smart packaging, and considering IoT and AI for predictive tracking.

By 2025, the appetite is there, but the rollout remains inconsistent. Digital twins, AI-based container forecasting, and integrated visibility platforms are emerging, but typically in isolated cases, not enterprise-wide deployments.

“We have a pilot for every problem, but no one wants to scale anything.”

The lack of standardisation, coupled with siloed budgets, remains a major barrier. Until packaging tech is embedded in cross-functional strategy, within procurement, logistics, sustainability and IT, it risks remaining a perpetual ‘future fix.’

Battery Packaging: The Disruptor No One Fully Anticipated

Perhaps the biggest curveball to emerge in the 2023 and 2025 surveys is the logistical impact of battery and EV component packaging.

In 2021, it was barely mentioned. By 2023, it had become a known challenge. In 2025, it’s seen as a serious disruptor. Battery modules and EV parts bring unprecedented size, weight, and safety concerns. They require specialised packaging, thermal insulation, and rigorous handling protocols.

“Battery packaging is where we realise how little we’ve modernised the system.”

It’s not just a packaging issue; it’s a network design issue. These parts don’t move like traditional components, and their packaging doesn’t return or recycle in the same way. Most existing systems weren’t built for this scale or risk profile.

This is where the gap between innovation and infrastructure becomes particularly stark.

Leadership and Ownership: Still the Missing Link

Across all three surveys, one constant remains: no one really owns packaging. Logistics teams manage it, engineers spec it, procurement buys it, and sustainability teams critique it, and yet no one is accountable end-to-end.

In 2025, this is still the case. And the consequences are familiar: duplicated designs, unused returnables, reactive fire-fighting, and missed opportunities for collaboration.

“Packaging is like the orphan child of the supply chain – everyone sees it, but no one wants to raise it.”

The industry knows it needs a more coordinated, cross-functional approach. But the leadership structures and incentives haven’t yet caught up.

The Core Message

Packaging has made huge strides in visibility over the past four years, but the operational maturity still lags. It’s moved from a logistics line item to a compliance risk, a cost pressure, and a sustainability lever. And yet, many of the same frustrations remain unresolved.

The insight that emerged from the 2021 survey still rings true today, but it’s taken on new weight and urgency:

“Packaging is not just a box. It’s a system and it needs to be treated like one.”